Beware of Diligent Scammers

There’s a common phrase that goes, “There’s no shortage of remarkable ideas, what’s missing is the will to execute them.” Well, in the case of scams targeting seniors, ideas and execution are NOT a problem.

There are more scams out there – and more everyday – than you can shake a stick at. The National Council on Aging (NCOA) reports that in 2021, there were 92,371 older victims of fraud resulting in $1.7 billion in losses. The most common financial scams targeting older people include government impersonation scams, sweepstakes scams, and robocall scams. Organizations like AARP have extensive information on their website about scams and the varying and creative ways scammers use to swindle you out of your money (or your identity).

Recently, one of our Saint Therese senior communities, was targeted by solicitors who called and texted residents asking them to donate money to Saint Therese for a specific project. This was not legitimate; it was a phishing attempt that, fortunately, our resident didn’t follow through on. (Phishing is a technique for attempting to acquire sensitive data, such as bank account numbers, through a fraudulent solicitation in email or on a web site, in which the perpetrator masquerades as a legitimate business or reputable person.)

Here are a few common scams according to the NCOA:

- Government impersonation scams – Scammers call unsuspecting older adults and pretend to be from the Internal Revenue Service (IRS), Social Security Administration, or Medicare. They may say the victim has unpaid taxes and threaten arrest or deportation if they don’t pay up immediately. Or they may say Social Security or Medicare benefits will be cut off if the victim doesn’t provide personal identifying information. This information can then be used to commit identity theft. Government imposters may demand specific forms of payment, such as a prepaid debit card, cash, or wire transfer. Using special technology, they often “spoof” the actual phone number of a government agency or call from the same zip code. This can trick some people into thinking the caller is from a valid source.

- Sweepstakes and lottery scams – Scammers call an older adult to tell them they’ve won a lottery or prize of some kind. If they want to claim their winnings, the older adult must send money, cash, or gift cards up front—sometimes thousands of dollars’ worth—to cover supposed taxes and processing fees. Scammers may impersonate well-known sweepstakes organizations (like Publishers Clearing House) to build trust among their victims. Of course, no prize is ever delivered.

- Robocalls and phone scams – One common robocall is the “Can you hear me?” call. When the older person says “yes,” the scammer records their voice and hangs up. Robocalls take advantage of sophisticated, automated phone technology to dial large numbers of households from anywhere in the world. While there are legal uses for this technology, robocalls can also be used to carry out a variety of scams on trusting older adults who answer the phone. Some robocalls may claim that a warranty is expiring on the victim’s car or electronic device, and payment is needed to renew it. Like with government impersonation calls, scammers often spoof the number from which they’re calling to make it appear as if the call is from a reputed organization.

- The grandparent scam – Scammers call a would-be grandparent and say something along the lines of: “Hi, Grandma, do you know who this is?” When the unaware grandparent guesses the name of the grandchild the scammer most sounds like, the scammer is able to instantly secure their trust. The fake grandchild then asks for money to solve some urgent financial problem (such as overdue rent, car repairs, or jail bond). They may beg the grandparent not to tell anyone. Since fraudsters often ask to be paid via gift cards or money transfer, which don’t always require identification to collect, the older adult may have no way of ever recovering their money.

- Medicare and health insurance scams – In Medicare scams, con artists may pose as a Medicare representative to get older adults to share their personal information.

- Internet and email fraud – Pop-up browser windows that look like anti-virus software can fool victims into either downloading a fake anti-virus program (at a substantial cost) or an actual virus that exposes information on the user’s computer to scammers. Their unfamiliarity with the less visible aspects of browsing the web (firewalls and built-in virus protection, for example), makes older adults especially vulnerable to such traps.

- Phishing emails and text messages – These may appear to be from a well-known bank, credit card company, or online store. They request an older adult’s personal data, such as a log-in or Social Security number, to verify that person’s account, or they ask the older adult to update their credit card info. Then, they use that information to steal money or more personal information.

Basic Tips to Avoid Scams

- If you receive a call and the person asks for anything personal, just HANG UP! Do not ever give them your address, Medicare number, family member names, credit card, etc.

- Never sign blank insurance claim forms.

- Give your insurance/Medicare identification only to those who have provided you with services.

- Protect your Medicare number as you do your credit card numbers and don’t allow anyone other than a trusted health provider to use it.

- Be wary of salespeople trying to sell you something they claim will be paid for by Medicare.

- Don’t buy from an unfamiliar company.

- Always ask for and wait until you receive written material about any offer or charity.

- Don’t feel pressured to make a quick decision; take your time.

The post Beware of Diligent Scammers appeared first on Saint Therese Blog.

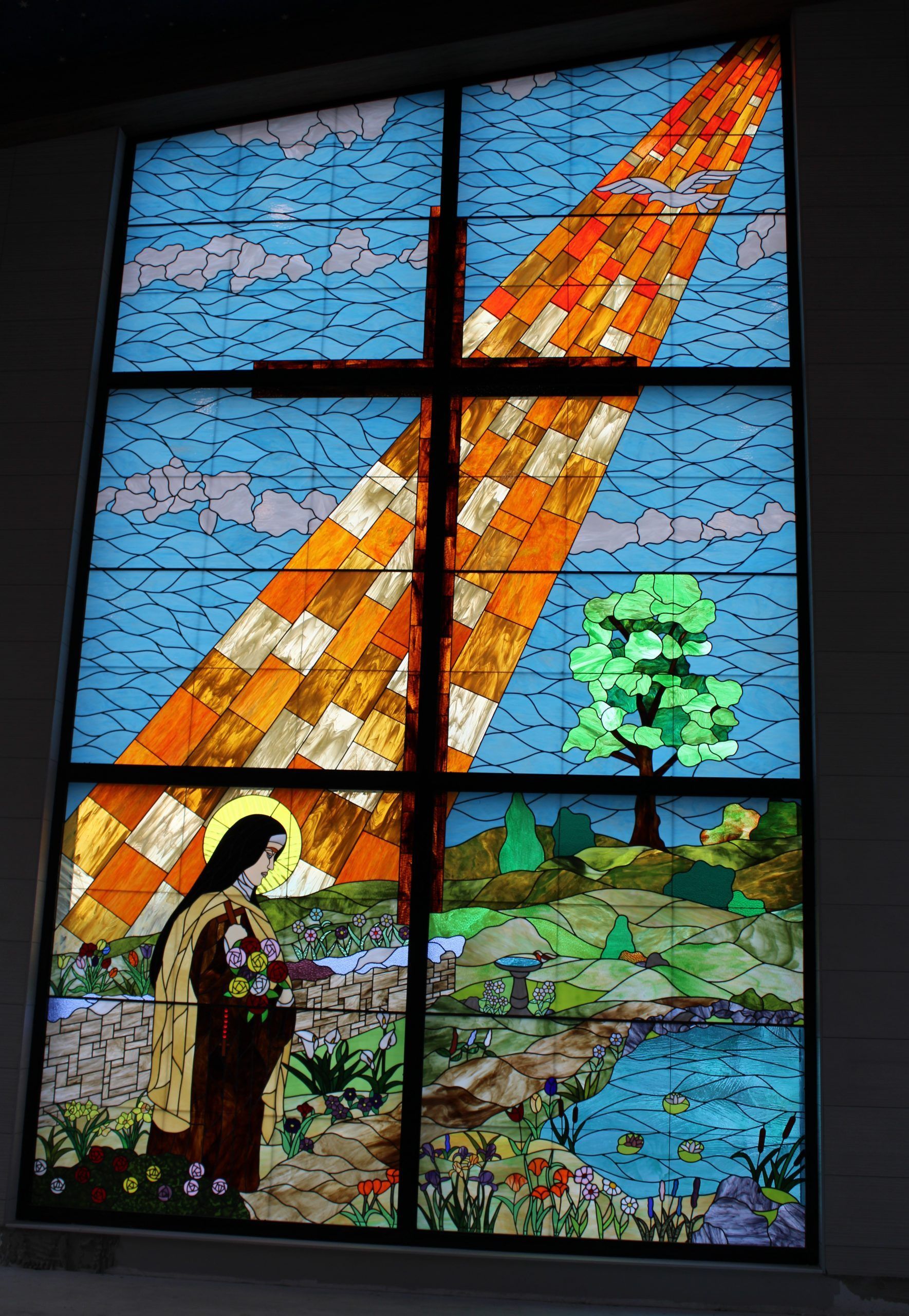

About

At Saint Therese, our heartfelt purpose since 1968 has been a people first approach to living well by providing senior care and services where every life we touch feels welcomed, respected, and heard. We achieve this by doing ordinary things with extraordinary love every single day. Contact us to learn more.